Like most investors, you look for investments with fail-safe interest or warranted return. Thus, many people invest in bonds or bank CDs through their Individual Retirement Accounts. However, with any kind of investment, risks are inevitable, despite how conservative you are as an investor. If you are making contributions to an IRA, getting average IRA interest rate is significant as it will shape your future retirement living, though it would be more beneficial to attain higher returns.

Financial consultants and investment advisors normally help people like you in making investment decisions by assessing your personality and needs. Two of the essential aspects you should look at though are your risk threshold and the possibility of getting interest rates for IRA lesser than the average or the anticipated.

Getting the Best IRA Interest Rate

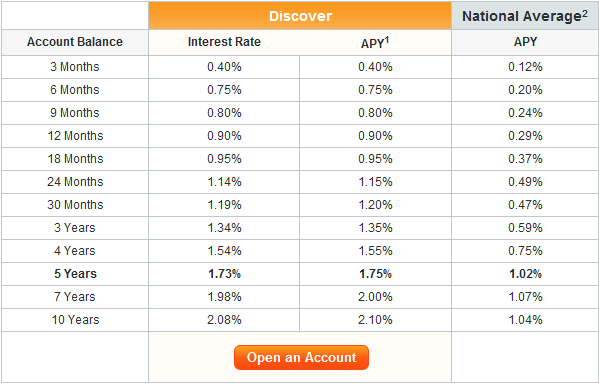

The best IRA rates we’ve discovered are from Discover Bank. They pay competitive IRA rates that consistently exceed the National Average.

Click on the chart below to review more information and updated rates:

Investing Risks

The real estate market has been deemed as one of the less risky retirement investments. This is for the reason that over the long run, the value of the property increases. Another extremely known and acknowledged form of investment is the FOREX market. However, this investment is very risky due to the continuous fluctuation taking place in the foreign currency exchange market.

Because of these concerns, any investor tapped on the back and told that there’s a method to get the average IRA return successfully, the information will be welcomed gracefully, particularly if the person is the more “risk averse” kind of investor. The lower your appetite for risk is the more you will choose investing platforms with lower risk. The apparent downside of this behavior is that you always miss great investing opportunities.

IRA Investing

Certificates of deposit come with guaranteed return, provided they mature before withdrawn. They are insured by the FDICs, making them more enticing to novice and “risk averse” investors. The average IRA CD rates are around 3%, but there are some financial institutions furnishing CD’s generating returns as high as 5% or more.

US Treasury bonds can also give your Individual Retirement Account guaranteed and average interest, because it is almost impossible for the US government to go bankrupt. Any investor can now buy $20,000 worth of US savings bonds every calendar year. However, you should remember that interest rates cannot really be estimated for savings bonds. Like when you invest in interest bearing checking accounts, your funds will grow, but grow quite slowly yet surely. It’s completely up to you if you can work with this system.

The idea behind a comfortable retirement is that you are more than willing to accept and work with a little calculated risk, so your retirement will reap the rewards later.

Best IRA Investments

Assess something like the real estate industry for instance. Many investors are not familiar with the idea that they can utilize their retirement accounts not only to invest in IRA MMA and other funds but also in real estate. Those who are aware of this option are most probably reaping the rewards of a wealthy retirement now.

Assess something like the real estate industry for instance. Many investors are not familiar with the idea that they can utilize their retirement accounts not only to invest in IRA MMA and other funds but also in real estate. Those who are aware of this option are most probably reaping the rewards of a wealthy retirement now.

In actual fact, the retirement investment options in the housing industry are astounding. While the most apparent choice would be rental property or family houses that you can use to make rental revenue, you can also make upgrades and market or sell them for huge profits.

There are specific rules that apply to this investment, which you should follow since you will not only receive the average Roth IRA interest rate but you’ll get more than what you’re expecting. All payments should come from your account, while all revenue and income must be sent back to your account. Otherwise, the Internal Revenue Service may strip your IRA account of its tax free or deferred status.

The real estate market has a few different segments, which provides you investing opportunities other than residential homes. You can use your IRA funds to invest in multifamily dwelling such as office building, beach house, or apartment building and produce income monthly.

An IRA that is invested in real estate market would make CDs and other investments less significant in terms of returns.

Final Note

To secure average IRA interest rate or higher rate of return, it’s best to consult a financial professional to help you reach your dreams for retirement sooner than expected.