For so many years now, people placed their funds in high yield savings accounts to improve the returns on their balance. However, because the interest rates have been mediocre or low through banks, most investors nowadays look for the so called high yield accounts, which are considered non-existent anymore. While this thinking may become a cause for alarm in some people, others are beginning to recognize other investment vehicles to save sufficient amount of money. One of the most popular options is the Roth IRA interest rates.

Compare the Best IRA Rates

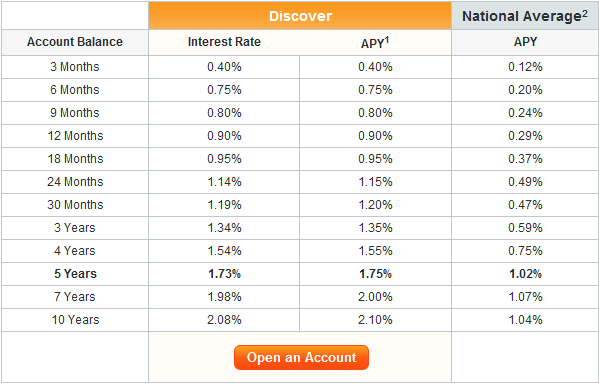

The best IRA rates we’ve discovered are from Discover Bank. They pay competitive IRA rates that consistently exceed the National Average:

Roth vs Traditional IRA

In general, people begin saving for retirement by opening an Individual Retirement Account (IRA). You may be prompted to choose between a traditional IRA and a Roth retirement plan, which offers dissimilar interest rates for IRA. Prior to selecting one, you must understand the significant differences between the two accounts. In actual fact, Roth IRA is a more popular preference. With this retirement plan, the contributions that you make will not be deducted when your taxes are filed. Some of the profitable investments accepted by the IRA as well as the Internal Revenue Service (IRS) under Roth IRA are real estate mortgages, gold bullion, oil and gas, real estate houses, structured settlements, and life settlements.

On the other hand, a traditional IRA has limited investment choices, wherein the contributions that you will make are set as post tax money. Thus, your contributed funds are tax-deductible, which lower your tax basis for a particular tax year.

Boosting Roth IRA Interest Rates

To be able to get high yields of Roth IRA rates, you must not only understand what types of investments are permitted and approved by the IRS and the IRA, but you should also determine which of those will fulfill your appetite for risks. You should realize that the higher the potential for profits the more risks involved.

Once you already have your own self-directed Roth IRA and you have been fulfilling the regular contributions needed, you can then ask your custodian to place your money in the stock market. However, because of the continuous fluctuations in this investment option, your account may fail to receive any growth rise – meaning the stock market may not give you a high return.

The best thing for you to perform to obtain the best IRA rates is to invest your money in other types of investments to establish your account appropriately and strengthen your portfolio. Again, while this sounds profitable and simple, as an investor, there are some risks integrated. Prepare yourself to go either way. You could lose a fortune that may be more than the amount you invest, or you can get immense returns you’ve never imagined.

In the end, the best step to take to turn your Roth IRA interest rates to high yield returns is to consult a skilled and experienced financial advisor to manage and handle your investment portfolio proficiently. High yield investments can be complicated and intricate to become skilled at, thus it is always best to allow an advisor to manage your portfolio. These people will ensure that your investments follow the IRS and Roth IRA rules while securing lucrative assets for comfortable retirement years.